Introduction

Understanding the GIC Explained process is crucial for Indian students planning to study in Canada in 2025. The Guaranteed Investment Certificate (GIC) has become an essential requirement for Canadian student visa applications, particularly under the Student Direct Stream (SDS) program. With updated requirements and increased amounts, getting your GIC Explained thoroughly can make the difference between visa approval and rejection. This comprehensive guide covers everything Indian students need to know about GIC in 2025, from eligibility criteria to the complete application process.

What is GIC? – Complete Definition Explained

GIC Explained in simple terms: A Guaranteed Investment Certificate (GIC) is a secure investment account required by the Canadian government as proof of financial support for international students. When people ask for GIC Explained, they’re seeking clarity on this mandatory financial requirement that demonstrates you have sufficient funds (CAD 22,895 as of September 2025) to cover your living expenses during your first year in Canada.

The GIC Explained concept becomes clearer when you understand its purpose: it’s not just an investment, but a government-mandated proof that you won’t become a financial burden while studying in Canada (Government of Canada – Student Direct Stream).

GIC Requirements 2025: Updated Amount and Regulations

Latest Update – GIC Explained for 2025:

- Minimum GIC Amount: CAD 22,895 (approximately ₹14.36 lakh)

- Previous Amount: CAD 20,635 (increased by CAD 2,260)

- Effective Date: September 1, 2025

- Processing Fee: CAD 150-200 depending on the bank

This significant increase in the GIC Explained requirements reflects Canada’s effort to ensure international students have adequate financial support (Vedantu GIC Guide).

Why is GIC Mandatory? – Purpose Explained

GIC Explained from the government’s perspective serves multiple purposes:

- Financial Security: Ensures students have guaranteed funds for living expenses

- Visa Processing: Speeds up Student Direct Stream (SDS) applications

- Risk Mitigation: Reduces the risk of students becoming financially dependent

- Regulated Disbursement: Funds are released monthly, preventing overspending

The GIC Explained requirement is mandatory for students from India, China, Morocco, Pakistan, Philippines, Vietnam, and several other countries applying through SDS (Shiksha GIC Guide).

Eligible Banks for GIC – Complete List Explained

GIC Explained through approved financial institutions:

| Bank Name | Processing Fee | Interest Rate | Online Application |

|---|---|---|---|

| ICICI Bank Canada | CAD 175 | 1.00% | Available |

| SBI Canada | CAD 150 | 1.05% | Available |

| Scotiabank | CAD 200 | 0.1% – 1.0% | Available |

| CIBC | CAD 200 | Variable | Available |

| RBC Royal Bank | CAD 200 | Variable | Available |

| TD Canada Trust | CAD 200 | Variable | Available |

These banks are authorized by the Canadian government to provide GIC services for international students (RBC GIC Program).

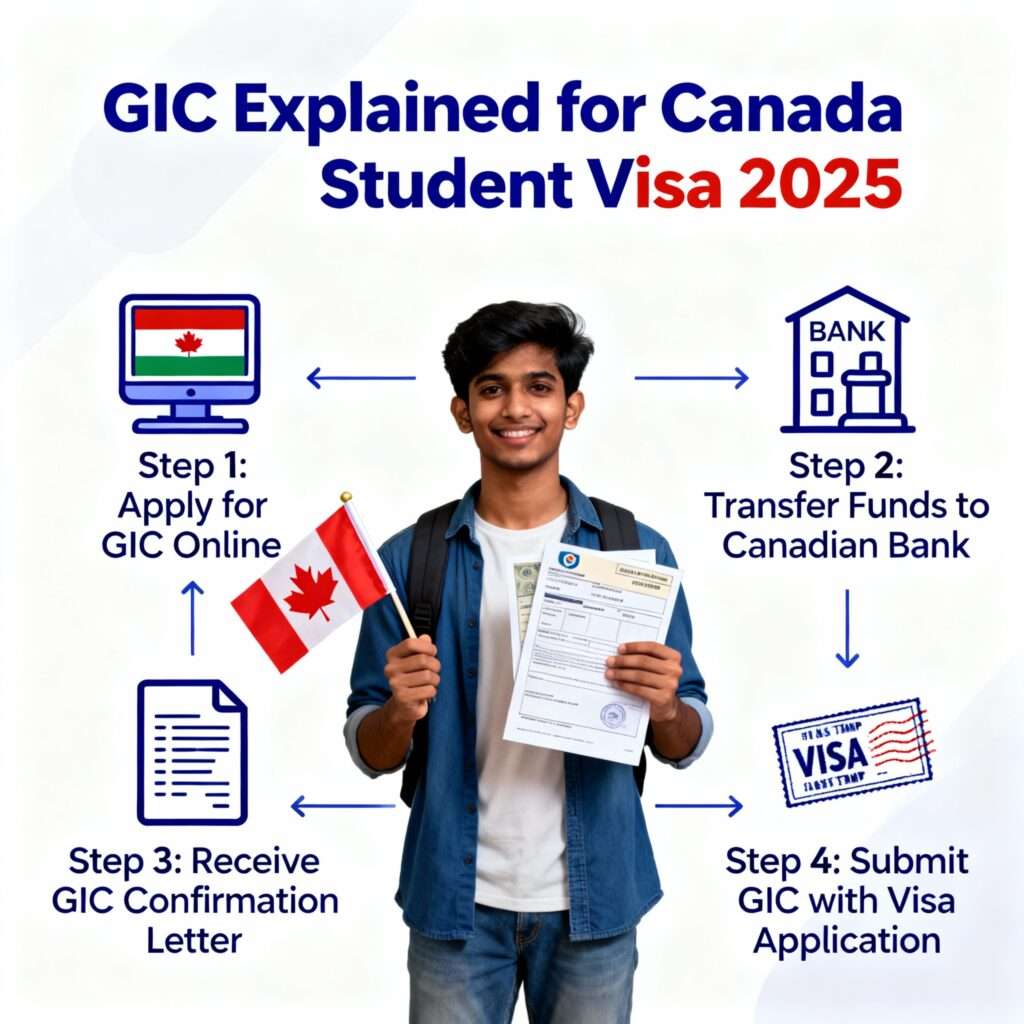

Step-by-Step GIC Application Process Explained

GIC Explained through detailed application steps:

Step 1: Choose Your Bank

- Research processing times and fees

- Compare interest rates and services

- Check online application availability

Step 2: Online Registration

- Visit the bank’s official GIC portal

- Create a new user account

- Verify your email address

Step 3: Document Submission

- Upload passport copy

- Submit university acceptance letter

- Provide PAN card and identity proof

- Include proof of English proficiency (IELTS/TOEFL)

Step 4: Fund Transfer

- Receive bank account details

- Wire transfer CAD 22,895 from India

- Pay processing fees separately

Step 5: Certificate Generation

- Bank verifies funds and documents

- GIC certificate issued within 7-15 business days

- Certificate required for visa application

GIC Explained: Eligibility Criteria for Indian Students

GIC Explained eligibility requirements:

- Nationality: Must be a resident of eligible countries (India included)

- Age: Minimum 18 years old

- Academic: Unconditional acceptance letter from Canadian DLI

- English Proficiency: IELTS 6.0+ or equivalent

- Documentation: Valid passport, PAN card, identity proof

- Financial: Ability to transfer CAD 22,895 + processing fees

GIC Explained eligibility is straightforward for Indian students who meet these basic criteria (GreenTree Immigration).

Cost Breakdown: GIC Amount in INR Explained

GIC Explained with complete cost analysis (as of October 2025):

| Component | Amount (CAD) | Amount (INR) |

|---|---|---|

| GIC Deposit | 22,895 | ₹14,36,000 |

| Processing Fee | 150-200 | ₹9,400-12,500 |

| Wire Transfer | 50-100 | ₹3,100-6,250 |

| Total Cost | 23,145 | ₹14,48,500 |

Exchange rate: 1 CAD = ₹62.70 (rates fluctuate daily)

GIC Fund Disbursement Explained

GIC Explained fund release mechanism:

- Month 1: CAD 2,000 released upon arrival

- Months 2-10: CAD 2,000 released monthly

- Final Month: Remaining balance + interest

- Total: Complete CAD 22,895 + accrued interest

This monthly disbursement system, when GIC Explained properly, helps students manage their finances throughout the academic year.

GIC Refund Policy Explained

GIC Explained refund scenarios:

- Visa Rejection: Full refund minus processing fees

- Admission Cancellation: Refund possible with proper documentation

- Medical/Emergency: Case-by-case basis

- Processing Time: 4-8 weeks after documentation

GIC Explained refund policies vary by bank, so review terms carefully before application (Unimoni GIC Guide).

Common Mistakes to Avoid – GIC Explained

GIC Explained common pitfalls:

- Applying too late (start 3-4 months before visa application)

- Choosing wrong bank (research processing times)

- Insufficient documentation (incomplete applications cause delays)

- Currency fluctuation ignorance (monitor exchange rates)

- Ignoring terms and conditions (understand refund policies)

Alternatives to Traditional GIC Explained

GIC Explained alternatives for non-SDS applicants:

- Bank statements showing 1-year living expenses

- Fixed deposits from Indian banks

- Education loans with international coverage

- Sponsor affidavits with financial proof

However, GIC Explained benefits make it the preferred option even for non-SDS applications.

GIC and Student Visa Timeline Explained

GIC Explained application timeline:

- Month 1: University application and acceptance

- Month 2: GIC application and fund transfer

- Month 3: GIC certificate receipt

- Month 4: Student visa application with GIC

- Month 5: Visa processing and approval

Proper timing is crucial when GIC Explained in context of overall immigration timeline.

Conclusion

GIC Explained comprehensively reveals that this financial requirement, while initially seeming complex, is actually a structured system designed to support international students. With the updated 2025 requirements of CAD 22,895, understanding the GIC Explained process becomes even more critical for successful visa applications.

The GIC Explained system provides security for both students and the Canadian government, ensuring adequate financial support while studying abroad. By following this detailed GIC Explained guide, Indian students can navigate the process confidently and increase their chances of visa approval.

Ready to start your Canadian study journey? Let Ausizz Migration Consultants simplify your GIC application process. Our expert team provides end-to-end assistance with GIC applications, documentation, and visa processing. Contact us today for personalized guidance and ensure your Canadian study permit success!

Frequently Asked Questions (FAQs)

Q1: What is GIC and why is it mandatory for Indian students?

A1: GIC Explained: It’s a Guaranteed Investment Certificate worth CAD 22,895 required to prove financial support for Canadian study permits under the SDS program.

Q2: How much GIC amount is required in 2025?

A2: The updated GIC amount for 2025 is CAD 22,895 (approximately ₹14.36 lakh), increased from CAD 20,635.

Q3: Which banks offer GIC for Indian students?

A3: ICICI Bank Canada, SBI Canada, Scotiabank, CIBC, RBC, and TD Canada Trust are authorized to provide GIC services.

Q4: Can I get a GIC refund if my visa is rejected?

A4: Yes, most banks provide full refunds minus processing fees if your visa application is rejected with proper documentation.

Q5: How long does the GIC application process take?

A5: The complete GIC process typically takes 7-15 business days after document verification and fund transfer.